Approaching Clients (Providers)

• It is a tough job to convince the provider as a beginner in medical billing business however we believe that it is not impossible. In that case hiring or welcoming expert people on board for the operations should be the priority.

• Email Marketing, Cold Calling, Brochures are some of the best ways to begin engagement.

• The most effective way to secure a meeting with the providers for their billing contract is reference. A good reference from someone in healthcare sector can play a vital role.

After the team is ready, approach providers office with generic website links in email marketing.

For example:

Dear New York provider,

Do you struggle with medical billing and coding? Are you tired of dealing with insurance companies? If so, then you need our help!

We are a medical billing and coding company that specializes in helping New York providers. We have a team of experienced professionals who can handle all of your billing and coding needs. We will work with you to ensure that your claims are accurate and submitted on time. We will also follow up with insurance companies to ensure that your claims are paid in a timely manner.

We understand that medical billing and coding can be a complex and time-consuming process. That's why we offer our services to help you free up your time so that you can focus on what you do best - providing quality care to your patients.

We offer a variety of services, including:

• Medical billing

• Medical coding

• Insurance verification

• Claim follow-up

• Patient collections

• Data analysis and Reporting

We are committed to providing our clients with the highest quality of service. We are also committed to working with you to find a solution that fits your budget.

If you are interested in learning more about our services, please contact us today. We would be happy to answer any questions you have and to provide you with a free quote.

Thank you for your time. We look forward to hearing from you soon. Sincerely,

Your company name and website

Billing and Coding Business Requirements

Business Structure: Decide on the legal structure of your agency, such as sole proprietorship, partnership, limited liability company (LLC), or corporation. Consult with a business attorney to determine the most suitable structure for your specific needs.

Business Registration: Register your agency with the New York State Department of State. You can choose to register as a DBA (Doing Business As) or under your chosen legal business structure.

Obtain Necessary Permits and Licenses: Check with the State of New York gov website to determine if there are any specific permits or licenses required to operate a medical billing agency in your area.

HIPAA Compliance: Familiarize yourself with the Health Insurance Portability and Accountability Act (HIPAA) regulations to ensure your agency maintains compliance with patient privacy and security standards. Implement appropriate administrative, technical, and physical safeguards to protect sensitive patient information.

Business Insurance: Obtain appropriate business insurance coverage, such as general liability insurance and professional liability insurance (errors and omissions insurance), to protect your agency from potential risks and liabilities.

Billing Software and Technology: Invest in medical billing software that complies with industry standards and helps streamline your billing processes. Ensure the software can handle claim submission, denial management, and reporting requirements.

Staffing: Hire knowledgeable and skilled staff with experience in medical billing, coding, and reimbursement processes. Ensure that your team stays updated with the latest industry changes and regulations.

Compliance with Coding Systems: Stay updated with current medical coding systems, such as ICD- 10 and CPT, and ensure your agency's coding practices align with industry standards.

Business Agreements and Contracts: Prepare contracts and agreements to formalize your relationships with healthcare providers, outlining the scope of services, pricing, and terms of engagement.

Ongoing Education and Training: Encourage continuous education and training for your staff to stay abreast of changes in medical billing regulations and technology advancements.

Virtual Setup

• For each account there must be a dedicated workstation setup.

• This business is very easy to setup since you can hire people 100% remotely.

• Paid USA VPN and a Secure data/file sharing portal.

• A good computer with internet access which is secure.

• Using website blocker tool is a good option. It will limit the internet activity only to authorized websites which are needed for the job. Online threat is real!

• Skype phone number, Fax number, official email.

Manpower

• For a practice ranging claims volume to 100-200. One full time employee.

• For a practice ranging claims volume to 200-400. Two full time employees.

• And so on.

• There should be someone also available in the US who can mail out documents or go to doctor’s office if needed. Most part of the job is totally online but sometimes insurance may ask something in the mail.

Contract Rate Negotiation

Your pricing model can be a percentage of reimbursement collected, a fixed fee per claim, or a monthly retainer fee.

State of New York is familiar for a fixed fee per claim pricing structure. Average charge per claim is four to six dollars.

Average charge for percentage based is three to eight percent depending on the size of the practice.

Monthly fee can start from twelve hundred dollars onward depending on the size of the practice.

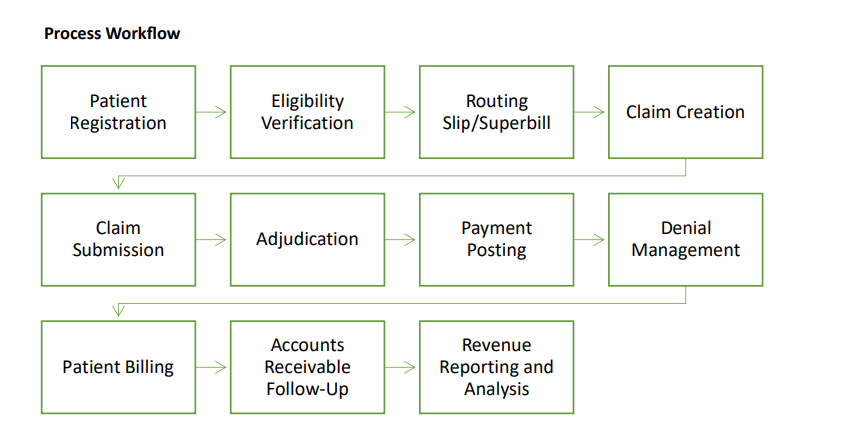

Process Workflow

1. Patient Registration: The billing cycle begins with patient registration, where their demographic and insurance information are collected and verified.

2. Eligibility Verification: The next step involves verifying the patient's insurance coverage and eligibility for the services being provided.

3. Charge Capture: Once the patient receives medical services, the healthcare provider documents the procedures, treatments, and services provided, along with corresponding medical codes (such as CPT and ICD-10 codes) that accurately represent the services rendered.

4. Claim Creation: Using the documented information, a medical claim is created with the necessary details, including patient information, provider information, codes, and charges.

5. Claim Submission: The created claim is then submitted electronically or through paper to the appropriate insurance payer for processing.

6. Adjudication: The insurance payer receives the claim and reviews it for accuracy, including verifying the patient's coverage, applying appropriate reimbursement rates, and assessing any policy limitations or exclusions.

7. Payment Posting: Once the claim is processed and approved, the insurance payer issues a payment to the healthcare provider. The payment is then posted in the billing system, reflecting the amount received.

8. Denial Management: In case of claim denials or partial payments, the provider reviews the reason for denial and takes appropriate action, such as appealing the decision, correcting errors, or resubmitting the claim with additional documentation if required.

9. Patient Billing: After the insurance payment is processed, the patient is billed for any remaining balance, including deductibles, co-pays, or non-covered services. A pa tient statement is generated, indicating the amount owed and providing payment instructions.

10. Accounts Receivable Follow-Up: The billing office follows up on unpaid patient balances, sending reminders, making collection calls, and working to resolve any outstanding accounts receivable.

11. Revenue Reporting and Analysis: Throughout the billing cycle, the provider tracks and analyzes key performance indicators, such as revenue generated, reimbursement rates, claim denial rates, and accounts receivable aging, to assess the financial health of the practice and identify areas for improvement.

It's important to note that the medical billing cycle can vary slightly depending on specific billing practices, insurance policies, and healthcare provider workflows.